tv Nightly Business Report PBS December 19, 2012 7:00pm-7:30pm PST

7:00 pm

of representatives is expected to vote tomorrow on the republican plan-b to avoid the fiscal cliff. house speaker john boehner thinks the house will okay the package, trying to turn the heat up on president obama to steer clear of automatic tax hikes and government spending cuts due to take affect in 12 days. still, as darren gersh reports, there are some signs the two sides are narrowing their differences. >> reporter: house republicans say they're still working on plan a: a big agreement with the president to cut spending and raise revenues, but they were pushing plan b today-- a tax hike for those making more than a million dollars. >> tomorrow the house will pass legislation to make permanent tax relief for nearly every american. 99.81% of the american people. then the president will have a decision to make. he can call on the senate democrats to pass that bill or he can be responsible for the largest tax increase in american history. >> reporter: hours before the speaker issued his challenge, the president said the two sides

7:01 pm

were not that far apart. just a few more steps the president suggested and republicans would have a deal in hand to tame the deficit for a decade. >> that is a significant achievement for them. they should be proud of it. but they keep on finding ways to say "no" as opposed to finding ways to say "yes." and i don't know how much of that has to do with it is very hard for them to say "yes" to me. >> reporter: there now appear to be two key sticking points: republicans want the president to offer up deeper cuts in entitlement spending totaling several hundred billion dollars over ten years. in return the president is determined to get a long-term extension of the nation's debt limit. last year, the fight over raising the debt limit brought the country to the edge of default. but house republicans see the debt limit as a crucial check on spending. >> i think they are very, very reluctant to give up this leverage-- what they consider to

7:02 pm

be the last leverage they may have next year on trying to get real entitlement reform and i think that accounts for a lot of it. >> reporter: but the president considers debt limit battles to be an irresponsible use of congressional power. >> i will not negotiate around the debt ceiling. we are not going to play the same game that we played in 2011, which was hugely destructive. hurt our economy. provided more uncertainty to the business community than anything else that happened. >> reporter: the house will vote on the republican plan b tomorrow. veterans of washington's budget battles wouldn't be surprised to see a plan c or d before a final resolution is hammered out. darren gersh, "n.b.r.," washington. >> susie: the threat of the fiscal cliff was a big topic at an investor conference in new york today hosted by johnson controls. this wisconsin-based industrial

7:03 pm

conglomerate is a leading provider of products to make buildings energy efficient, and it's also the world's largest maker of car batteries and automotive seats. c.e.o. stephen roell told me he's worried that uncertainty about the fiscal cliff could hurt consumer confidence, and his business. >> we don't do that. as the consumer, i products to costumers like the big three, that in turn sell to the auto industry. my biggest concern is how it will affect the psychology of the consumer. i've been surprised, susie, that people continue to buy automobiles. but my fear is that could change dramatically. >> susie: steve, to what extent are the ups and downs impacting your business day to day. >> i think people are holding back on making captain investments. i see that particularly in the building side. from my standpoint, i continue to invest around the world. i'll invest to make sure i'm buying the strategies we laid up for the next three years. the question is what it

7:04 pm

will do, depending on what the outcome is, how is it going to alter my strategies if the out come is different than i thought. >> susie: higher taxes is going to be a part of any deal. >> right. >> susie: are you open to higher taxes? how does it impact your business? >> i'm open to it. but i'm concerned and i don't want to be uncompetitive. i've got to make sure whatever tax structure works, i'm more concerned about how it impacts my ability to do business around the world. am i disadvantaged against other nations or benefit from other nations' tax structures. >> susie: you told analysts today that johnson controls is going to post higher earnings and sales in 2013. but if for some reason these negotiations -- we don't have a deal and we go over the cliff, how is it going to impact your forecast for next year. >> it would impact our growth, obviously. it will manifest itself in how production changes.

7:05 pm

and that's the biggest issue. but i have so many issues. for example, we're still trying to figure out europe and the depth and duration of that economy. that's just one of many. clearly i don't need another challenge coming from the uncertainty around the fiscal cliff. >> susie: you do a lot of business in china, and you're very bullish on china. can your business in china offset any during you might have in your business from what goes on in the u.s. economy? >> probably not. i'm bullish in the auto business and the building trades, but that is not going to be enough to offset the fiscal cliff, and we're going to have to manage europe at the same time. >> susie: let's say there is no deal and the u.s. economy really slows down, or as some people say could go into a recession, how are you preparing for that possibility? >> we're trying to make those investments that are strategic, and holding back on our hiring because we don't know the growth rates.

7:06 pm

we're probably looking at the different ways to reduce our points from a logical standpoint, and we're trying to pull every lever to give us some latitude and leverage. >> susie: what deal would you like to see come out of washington? what would be best for your company? >> probably making certain that the tax increases don't go all the way down to the middle class. i think we've just got to make sure the majority of people can still protect their me net pay right now. my biggest concern is -- what the government could do is make sure that the middle class and the buying power of the u.s. is not impaired in any way. >> susie: do you think we're going to have a deal by the end of the year treg. >> i think we'll have a deal, but my concern is it will be predicated on some future action and we'll have to kick the can down the road again. that's my fear as well.

7:07 pm

>> tom: if you're anxious about the fiscal cliff, you're not alone, still ahead, how some americans are cutting back, and how the cliff is impacting both investor and consumer behavior. stocks headed south on wall street as debate over the fiscal cliff heated up in washington. adding to those worries, word that fitch ratings repeated its threat to strip the u.s. of its triple "a" credit rating if we go over the cliff. the dow fell 99 points, the nasdaq lost 10, the s&p down 11.

7:08 pm

>> tom: u.b.s., the big swiss bank, is putting accusations of interest rate manipulation behind it. the bank will pay $1.5 billion to settle charges of rigging a key international lending rate. the u.s. justice department also filed criminal charges against two u.b.s. traders, and a unit of the bank itself. the agency calls the bank's conduct, "simply astonishing." >> hundreds of trillions of dollars in mortgages, student loans, credit card debt, financial derivatives and other financial products worldwide are tied to libor, which serves as the premier benchmark for short term interest rates. in short, the global marketplace depends upon all of us relying on an accurate libor. yet u.b.s., like barclay's before it, sought repeatedly to fix libor for its own ends. >> tom: the probe into the libor interest rate manipulation involves more than a dozen major financial institutions including barclays, bank of america, and societe generale.

7:09 pm

>> susie: uncle sam may soon be exiting the auto business. the treasury department said today it will sell its remaining and controversial stake in general motors, in the next 15 months. as part of the deal, g-m will buy back $5.5 billion in shares, and that will happen by the end of this year. g.m. stock revved higher on the news, climbing 7% to $27 a share. and, as suzanne pratt reports, some investors like the sound of an independent g.m. >> reporter: it looks like general motors may soon be hitting the road all by itself. four years after spending nearly $50 billion to rescue the struggling automaker, the u.s. treasury wants out. and, gm needed to shake off the stigma of being known as government motors. >> general motors to wanted do this. they wanted to get the government off its back so to speak and to prove to the people they can pay back the loan, part of the loan. >> reporter: other auto experts says everyone involved wanted to end this year on a positive news

7:10 pm

note. >> it helps the folks at gm and the government end the year on a high note and send us into 2013 with a positive wind at our sails. >> reporter: what's not very positive is that taxpayers stand to lose billions of dollars on the g.m. bailout. in fact, if treasury sold all of its remaining shares today, it would mean a net loss of nearly $13 billion, or about a quarter of the government's total investment. for its part, treasury argued today the gm bailout saved a million jobs that would've have been lost if g.m. shuttered its factories. still, in order for taxpayers to recoup the money spent on gm, the stock would need to surge to about $70 a share. that's unlikely, particularly with g.m. currently trading at less than 30 bucks a share, well below their 2010 i.p.o. price of $33. nevertheless, while uncle sam is selling his stake in g.m., some

7:11 pm

auto experts say investors should consider buying one of their own. after all, the employment picture is on the rise in the u.s. and so is consumer confidence. and, g.m. is getting its financial house in order. >> we've seen that the company has continued to strengthen its balance sheet , it's making money, it's continuing to be profitable, it adding cash to the balance sheet. it should be in a positive position on a going forward basis. >> reporter: that's not to say there aren't challenges on the road ahead for g.m., including serious softness in europe. but most agree g.m. can and will drive into the future on its own. suzanne pratt, "n.b.r.," new york. >> susie: our "nbr-u" partners at wharton have new research showing how accounting for government loan guarantees, like the one given to g.m., is impacting uncle sam's bottom line. you can learn more on the web, just head to: www.nbr.com and look for the "nbr-u" tab.

7:12 pm

>> tom: look for the dirt two fly in coming months. permits to build new homes in the u.s. shot up to more than a four-year high last month as actual home building slowed down a bit. housing starts fell 3% in november from the month before, but it has been a strong recovery, compared to a year ago, housing starts up 21.6%. the building permit, jumping 3.6% in november, up to their highest level since july 2008.

7:13 pm

martin connor is the chief financial officer, and he joins us tonight from pennsylvania. marty, welcome back to n.b.r. have you been out there increasing your building permit for next year? >> tom, it is great to be with n.b.r. i do think we are increasing our permits. we've seen dramatic increases in our sales through the first four quarters of our year, all four quarters of our year. they went from the mid-40s to the mid-50s to the mid-60s, to 75% growth, fourth quarter over last year's fourth quarter. so we're optmatic about 2013. >> tom: your boss, the c.e.o. of tol brothers, signed a letter to president obama and john boehner, saying, quote,"failing to reach an agreement on the fiscal cliff will shake the confidence of american consumers." so home building is a long tale to it. why take the chance with your optimism given there is still no resolution? >> we're a long land

7:14 pm

builder. we own the land well in advance of when we actually put it in use. so we're positioned for the continued recovery. we have made those investments in areas where we operate, it is hard to get land. there is not a lot of land sitting around. having us puts us in a competitive v.. we're confident sensitive, though. demand is confident sensitive. and we have seen demand recover because consumers' confidence has improved, and their confidence that housing as a sound investment has improved, as they have seen prices rise year-over-year here. >> tom: where is building best for you? where are you looking to put shovels in the ground come springtime? >> we've had a lot of success in texas. our urban products in the metro new york area have met with great success. and we're pleased to be between washington and boston with approximately 50% of our business because that market

7:15 pm

continues to be reasonably strong. >> tom: that is a hot area. >> out on the west coast -- the job markets -- i think texas seems to have its own economy. the job market in texas is pretty strong. i think california has been reasonably strong for us as well. particularly up in the silicon valley area. i think the success of a number of the companies up there is driving the market. and seattle is another pretty wels well-positioned employment base and we've seen good sales up there. >> tom: from the east coast to the west coast with toll brothers chief financial officer martin connor with us. >> susie: investors are trading on headlines, and the head is all about fiscal cliff. yesterday the dow was up 100 points. today down 100 points all because the headlines weren't looking at favorable. >> tom: just very sensitive to any of the rhetoric coming out of washington for the stock market here, susie.

7:16 pm

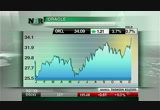

in our "market focus," we can see indications of that. from the post-election highs we had yesterday, and the selling picked up a little bit as the day wore on today. here is the trade for the s&p 500. the s&p 500 slipped into the red within the first 20 minutes of trading, with the losses growing in the afternoon to end at the lowest level of the session, down 0.8%. trading volume was 747 million shares on the big board. just under two billion on the nasdaq. all 10 major stock sectors were down. the telecommunications sector saw the biggest drop, off 1.2%. health care fell 1.1%. consumer staples shed 1%. in the health care sector, intuitive surgical suffered the steepest loss. trading volume was very heavy, almost 10 times its average pace with shares falling 5.7%. a research firm known for selling short stock, profiting when prices drop, voiced worries about certain uses for intuitive's robotic surgical equipment. we saw more selling in some cigarette stocks. as we previewed last night, the european union today proposed

7:17 pm

bigger health warnings on cigarette packages and a complete ban on strong flavors like menthol. philip morris shares dropped 2.1%. it is the world's biggest cigarette maker measured by revenue. in the dow, some analysts concerns hit shares of general electric and alcoa. g.e. fell hard, down 3.1%. investment bank u.b.s. removed the stock from its favored list thinking earnings growth will slow. alcoa dropped 3%. moody's put the company's credit rating on review for possible downgrade, thanks to falling aluminum prices. fighting against the weak market was oracle. the database software reported a strong quarter last night. and shares responded, jumping 3.7%, taking the stock to its highest price since the spring of 2011. digital storage stocks rebounded. western digital was up four percent. seagate technology increased 3.3%. both received positive analyst comments.

7:18 pm

fed-ex delivered earnings that were down from a year ago, but still stronger than anticipated. the drop from a year ago was blamed on customers using lower priced shipping options instead of the higher priced express shipping. shares gained 0.9% on strong volume. it pushed the stock to a six week high. the company stuck with its previous financial outlook for the full year. after just five months on the job, the c.e.o. at martha stewart living omni-media is quitting. lisa gersh restructured the company's publishing unit, shutting down one magazine, whole living. after an initial sell off today, the stock rebounded to finish up 2.1%. volume was almost 10 times average. the wall street journal reports the company wants a c.e.o. with more experience in retail and merchandising. three of the five most actively traded exchange traded products were lower. the japan e.t.f. had the strongest gains, up 1.6%. and that's tonight's "market focus."

7:19 pm

>> tom: while the economy approaches the fiscal cliff, some americans say the threat of higher taxes has them cutting back on spending. a third of those surveyed by bankrate.com have reduced their spending thanks to the fiscal cliff show-down in washington. those cutting back are more likely to consider themselves republicans or independent voters according to the survey. and while the tax debate is over high income earners, it's those earning less than $30,000 a year who are more likely to reduce their spending. we recently spoke with two behavioral finance professors about the impact the uncertainty can have for consumers and investors.

7:20 pm

they are professors at the university of miami. gentlemen, thanks for joining us. how do the fiscal cliff, the threat of the fiscal cliff, how could it be impacting consumer behavior? >> right now it could generate a lot of uncertainty in the minds of consumers. different demographics might react very differently. specifically, the 1% or 2% at the top, where the democrats are proposing very large tax increases, or the repeal of the bush tax cuts to that group, it could affect their consumption decisions ahead of the holidays. they might choose to pull back or wait to see what the ultimate resolution might be. >> tom: is that going to be enough to show up in economic statistics that we see in december? >> well, sure. i mean, based on what i know, based on my previous research, given that, you know, especially looking at investor behavior, we know that investors are

7:21 pm

more likely to make mistakes when there is greater market-wide uncertainty, and we can see that in their decisions to trade, and trade more actively, and make bigger mistakes. they don't understand the implications of all of the tax cuts and so on. and they're likely to make bigger mistakes, which taken together could have an impact on the market. >> tom: what about from the company's perspective? because we've heard from a lot of c.e.o.s that have frozen plans until 2013, waiting for some kind of certainty, which may be unlikely to come. >> it essentially tells us when there are high levels of uncertainty in the economy, the option to wait increases. where you have ir reversal investment, it makes sense to wait. >> tom: this will sound like a silly question, luke, but uncertainty is a fact of life. all c.e.o.s and

7:22 pm

investors have to deal with uncertainty. what makes this uncertainty any different from periods past? >> i don't think one is any different, in my mind, at least. when people study the impact of uncertainty on people's behavior. this is, you know -- the difficulty is people don't learn as much from previous instances of uncertainty. they are likely to make single mistakes and repeat those mistakes, as a result of which every new instance is like a new one. >> tom: we'll leave it there, professors. jawad addoum and luke kuom with the university of. >> susie: tomorrow on "n.b.r." a check on the housing market, with quarterly results from k.b. >> susie: as you look at your gift giving list this year, you probably have toys and clothing high up. but beauty products like fragrances and skincare are selling even better. beauty is expected to be the top

7:23 pm

category this holiday season: up more than 7%. it's also the top retail category of the year. and as erika miller reports, it's not just women lining up at the cosmetics counter these days. >> reporter: like a growing number of men, zach bruno is paying more attenion to the skin and grooming products he buys. >> i came from being younger, out of school, not really caring about that sort of thing, and as i became more of an adult, with a real job and my own apartment, i felt like okay, i need to take care of myself a little better, inside and outside. >> reporter: so, he recently bought a subscription to a service called birchbox. once a month, he receives a box of samples of grooming and lifestyle products tailored to his needs. >> i've only gotten two boxes so far, and they range from skincare, haircare, i got a tie, which i thought was pretty cool. and the one kind of tie i don't have. >> reporter: if he likes the selections, he can buy more at the birchbox website. most of birchbox customers are still women, but katia beauchamp says sales of men's products are growing more quickly. >> but if you are able to show them how this is valuable how this is something that is

7:24 pm

actually addressing their needs and explain to them, you are looking for this. this is what this product delivers. it actually helps them. >> reporter: the increase in sales of personal care products may also be partly due to an aging adult population, wanting to look younger. it's also possible the strong sales of men's skincare products this year, may be tied to clothing sales last year. >> men's apparel was up all year last year. and now we're seeing this cosmetic or health and beauty up. so maybe their closet's full, and they're done replenishing their clothing. and they're working on other things that they need. >> reporter: and holidays or not, we all love discovering a new product that makes us look and feel better: >> it's like a little present every month i get for myself. oh surprise! >> reporter: erika miller, "n.b.r.," new york. >> susie: tom, something for you to think about. >> tom: shaving cream in my shocking, maybe. >> susie: that's "nightly business report" for wednesday, december 19.

7:25 pm

have a great evening everyone, and you too tom. >> tom: goodnight susie, we'll see you online at: www.nbr.com and back here tomorrow night. captioning sponsored by wpbt captioned by media access group at wgbh access.wgbh.org >> join us anytime at nbr.com. there, you'll find full episodes of the program, complete show transcripts and all the market stats. also follows us on our facebook page at bizrpt. and on twitter @bizrpt.

7:29 pm

narrator: explore new worlds and new ideas through programs like this. made available for everyone through contributions to your pbs station from viewers like you. thank you. matthew morrison: he was the third generation in a family of theatrical producers. his grandfather oscar the first in opera, his father, willy, in vaudeville, his uncle arthur in operetta. oscar the second was blessed by genes and genius. he wrote the lyrics for over a thousand songs and the books for 45 operettas and musicals, many of them made into films, and still being performed today. no one changed theater history more than oscar

196 Views

IN COLLECTIONS

KQED (PBS) Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11